Warren Buffett’s Most Surprising Discovery

William N. Thorndike, Jr. explains how doing the opposite of everyone else helped a group of outsider CEOs achieve unprecedented performance and beat the market by a factor of 20.

Every year he’d get a fifteen minute window to make his offer.

On a dreary day in February 1967, Charlie Heider was having lunch with Jack Dabney Ringwalt, the founder of National Indemnity. Every year something would come up, some claim or something would irritate Ringwalt to the point of wanting to sell his company. He would stay in that state of mind for only fifteen minutes. This was one of those days.

Heider, who sat on the board of National Indemnity, immediately got in touch with Warren Buffett, and they arranged a meeting with Ringwalt—that very afternoon. Ringwalt hesitated. He started laying out various conditions: that Buffett wouldn’t move the office, that he wouldn’t fire the staff, that he would pay more than the offers Ringwalt received so far. Buffett understood how close Ringwalt was to changing his mind, so he agreed to everything, even the fifty dollars per share, which Buffett thought was fifteen dollars more than the company was worth. But even after shaking hands, Ringwalt continued to hesitate. In Buffett’s own words:1

So we made a deal in that fifteen-minute zone. Then, Jack, having made the deal, really didn’t want to do it. But he was an honest guy and wouldn’t back out of a deal. However, he said to me after we’d shaken hands, “Well, I suppose you’ll want audited financial statements.” And if I’d have said yes, he would have said, “Well, that’s too bad, then, we don’t have a deal.” So I just responded, “I wouldn’t dream of looking at audited financial statements—they’re the worst kind.” We went through about three or four iterations like this. And finally Jack gave up and sold me the business, though I don’t think he really wanted to do it.

The contract Buffett drew up was just one page long. This was quickly signed and the funds promptly deposited in the U.S. National Bank.

This way of doing business—waiting patiently for years and then pouncing on a deal, totally ignoring the audit process, using a one page contract—is not how typical companies operate. It is, however, the norm for a small group of outlier CEOs described in William N. Thorndike, Jr.’s Outsiders. Despite doing almost the opposite of everyone else, these CEOs managed to beat the market many times over. On average they outperformed the S&P 500 by over twenty times by the end of their careers, as measured by the increase in per share value of their companies.

The secret to their incredible success is twofold.

Buffett’s most surprising discovery

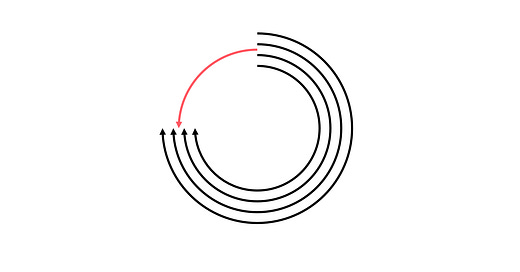

In a 1989 letter to Berkshire Hathaway shareholders, Buffett shared what he called his “most surprising discovery”: an “unseen force” he dubbed the institutional imperative. He used the term to describe the tendency of management to blindly follow inertia or to mindlessly imitate the actions of their peers instead of making their own independent decisions based on reason. Buffett describes some of its attributes:2

For example: (1) As if governed by Newton’s First Law of Motion, an institution will resist any change in its current direction; (2) Just as work expands to fill available time, corporate projects or acquisitions will materialize to soak up available funds; (3) Any business craving of the leader, however foolish, will be quickly supported by detailed rate-of-return and strategic studies prepared by his troops; and (4) The behavior of peer companies, whether they are expanding, acquiring, setting executive compensation or whatever, will be mindlessly imitated.

Thorndike suggests that the outlier CEOs who managed to massively outperform the market and their peers avoided the institutional imperative by replacing it with a different worldview that drove their decisions, and this worldview, this approach to business, is actually similar between them:

… they disdained dividends, made disciplined (occasionally large) acquisitions, used leverage selectively, bought back a lot of stock, minimized taxes, ran decentralized organizations, and focused on cash flow over reported net income.

Buffett is, perhaps, the most extreme example of an unconventional CEO, so much so that Thorndike compiled a list of the differences between his management style and that of Jack Welch of General Electric, one of the most famous CEOs of all time:

Welch

Smooth earnings pattern

400,000 employees

Thousands of HQ staff

Lots of travel

Primary activity: meetings

A lot of time spent on investor relations

Frenetic and busy tone of workday

Changes managers a lot

Frequent off-site meetings

Regular strategic planning

Does stock splits

Buffett

Lumpy earnings pattern

270,000 employees

23 HQ staff

Little travel

Primary activity: reading

No time spent on investor relations

Quiet and unscheduled tone of workday

Almost never changes managers

No off-side meetings

No strategic planning

No stock splits

And yet, what might seem on the surface to be a series of idiosyncratic quirks is actually a rational strategy to optimize his time for something that, in the long run, is more productive than the day-to-day operations of a large company. By decentralizing his operations and letting the CEOs of his subsidiaries run their companies without his involvement, Buffett carves out the time for himself to think, to step back and focus on the bigger picture. By resisting the institutional imperative, he makes time for an activity that most of his peers have no experience in, but which is the keystone to his success: capital allocation.

What they don’t teach at business school

CEOs have two main functions: operations, the running of a company, and capital allocation, the “the process of deciding how to deploy the firm’s resources to earn the best possible return for shareholders.”

Management books focus on operations. Top business schools don’t even teach capital allocation. As a result, most CEOs tend to focus on operations, having little to no experience allocating capital. Here’s how Buffett explained it:

The heads of many companies are not skilled in capital allocation. Their inadequacy is not surprising. Most bosses rise to the top because they have excelled in an area such as marketing, production, engineering, administration, or sometimes, institutional politics. Once they become CEOs, they now must make capital allocation decisions, a critical job that they may have never tackled and that is not easily mastered. To stretch the point, it’s as if the final step of a highly talented musician was not to perform at Carnegie Hall, but instead, to be named Chairman of the Federal Reserve.

Operations are important, but when the company grows beyond a certain size, figuring out where and how to deploy capital becomes much more crucial. Not surprisingly, all of the outsider CEOs in Thorndike’s book focused on capital allocation to achieve their exceptional success, leaving operations to their skilled lieutenants.

To understand the importance of capital allocation, let’s look at the story of one of Thorndike’s outsiders: John Malone of Tele-Communications Inc. (TCI), a paragon capital allocator.

John Malone and TCI

TCI was a cable television company founded in 1956 by Bob Magness. What attracted Magness to the industry was its favorable tax characteristic. This was an extremely capital intensive industry. Operators had to purchase, build and maintain systems if they wanted to grow. But this also meant that prudent operators who spent all their profits on expansion could avoid paying taxes since they would have no profits to report. Additionally, the tax burden could be decreased by taking on debt and depreciating existing assets. As Magness himself quipped, it’s “better to pay interest than taxes.”

During his time as a consultant at McKinsey in the 1970s, Malone recognized this favorable tax characteristic of the cable television industry. When he was only twenty-nine years old, one of his clients saw his analytic genius and hired him to run their cable division called Jerrold. Very soon, other cable companies wanted him on their team. In 1973, TCI, the fourth-largest cable company at the time, asked him to become its CEO, which he accepted.

Malone came aboard at a bad time. TCI had plans to go public in 1972 in order to get enough money to pay off some of its massive debt burden, but new regulations decreased interest in cable stock, and the company changed its mind. The debt load remained, however, and Malone needed to figure out a way to reduce it. Adding to this, the 1973–1974 Arab oil embargo destroyed liquidity, affecting the entire industry. As Malone himself put it, his first days at TCI were “lower than whale dung.”

Malone tackled the challenge facing him with operational discipline and spartan frugality. He gave his managers the freedom to operate independently, as long as they met their growth targets. He cut down on spending. Despite being one of the largest media companies at the time, corporate headquarters had few secretaries, only one receptionist, and the phone was answered by a machine. “Holiday Inns were a rare luxury for us in those days,” remarked J. C. Sparkman, whom Malone hired to run operations. In 1995, the year Sparkman retired, TCI was serving 12 million subscribers with just 17 employees at corporate.

Thorndike suggests the idea of an edifice complex—“an inverse correlation between the construction of elaborate new headquarters buildings and investor returns.” Companies that, at the time, constructed lavish headquarters (The New York Times Company, IAC, Time Warner) did not beat the market with their returns. All of the outsider CEOs, however, spent very little on their officers, while enjoying spectacular returns.

This frugality had favorable second-order consequences, namely: TCI “gained a reputation with its investors and lenders as a company that consistently underpromised and overdelivered.” If you show investors and lenders that you are not wasting their money, they’ll be more willing give you money in the future. By 1977, TCI replaced their bank loans with lower-cost debt from a consortium of insurance companies, thereby remedying their financial difficulties.

Malone then moved to implement a strategy that would take TCI to incredible heights and generate truly extraordinary returns for its shareholders. The key to cable television was size. The biggest operating expense was the fees paid to programmers (HBO, MTV, ESPN, etc.). The more subscribers you have, the more leverage you have to bring those costs down, thereby increasing the profit margin you make per subscriber.

Now, this wasn’t anything new. Everybody in the industry recognized the advantage of size. But for some reason nobody else pursued this as aggressively and intentionally as Malone, who, seeing that the math worked out, took it to an extreme. His virtuous cycle was this: he would buy more systems, which would lower lower programming costs, which would increase cashflow, which would then give him more financial leverage to buy more systems, and so on, repeating the cycle.

Between 1973 and 1989 TCI had made 482 acquisitions—about one every other week. In making acquisitions Malone focused on value, focusing on cheaper urban and suburban subscribers, while his competitors went for expensive urban franchises. Some of those urban franchises later collapsed, and Malone was able to grab them at a discount. By 1982, TCI was the largest company in the industry, and by 1987 it was twice as big as its next largest competitor.

A key element of TCI’s strategy was to minimize the amount of taxes owed by the company, which, as we have seen, was done by investing cashflow into new systems, taking on debt, and depreciating existing assets. One of the effects of this approach was that the company had no profits to report. At the time, the metric used by Wall Street to gauge the success of a company was earnings per share (EPS), and since TCI had no earning, it had no EPS to speak of. To address this, Malone invented EBITDA (earnings before interest, taxes, depreciation and amortization), which shifted the focus away from earnings to cashflow—something TCI had in abundance. EBITDA has since became a commonplace accounting staple, but in the 1980s it was a very unconventional approach.

During market downturns, Malone repurchased stock at a discount. Stock repurchases are a way to reward investors who want to sell and to increase the share price for those who choose to keep the stock, but they were unconventional in the 1980s due to being perceived as a way of trying to prop up a failing stock. Thorndike’s outliers, however, have all recognized the advantage of share buybacks, and have all made significant repurchases during their careers. By 1979, Malone and Magness owned 56 percent of controlling stock, preventing hostile takeovers.

By the end of his career in the late 1990s, Malone began to reap the harvest of his life’s work, and what a harvest it would turn out to be. He started off selling off some of TCI’s auxiliary projects. Teleport went to AT&T for $11 billion in 1997. The Sprint/PCS joint venture was purchased by Sprint Corporation for $9 billion in Sprint stock in 1998. In 1999, Motorola bought General Instruments for $11 billion. Finally, to crown it all, TCI itself was sold to AT&T for an EBITDA multiple of twelve—an extraordinary $2600 per subscriber. The Malone era of TCI, from 1973 to 1998, had a compound return of 30.3 percent for its shareholders, more than twice that of the S&P 500. A dollar invested with TCI in 1973 would be worth over $900 by the end of Malone’s tenure, while the same dollar invested in S&P 500 would be worth $22. Malone outperformed the market by a factor of 40.

Malone is an example of a capital allocating CEO. He delegated operations to his top lieutenant, J. C. Sparkman, while he focused on figuring out the best way to make use of the cashflow the business was generating. He is also an example of a CEO who resisted the institution imperative. Instead of trying to boost his earnings per share—something that would have been impossible with his strategy—he came up with a totally new metric to evaluate the health of a company (EBITDA) in order to allow Wall Street to make sense of his business. He eschewed expensive headquarters and large staff for a lean, decentralized organization. He ignored the rush for expensive urban acquisitions, letting his competitors lose their money, and picked up the pieces at bargain prices after they collapsed. Whenever TCI stock fell in price, he bought back the shares, boosting their value and consolidating his hold over the business. Because he knew his math worked out, he pursued his acquisition strategy aggressively, which, because his assumptions were correct, sped up the virtuous cycle and produced ever greater results.

“They haven’t repealed the laws of arithmetic…yet anyway,” Malone once joked. But that quip also embodies the essence of the outsider CEOs’s success: they resisted the temptation to imitate others and followed their own reason, even when it led them to make decisions that went against the general trends. As Benjamin Graham once said: “You are right not because others agree with you, but because your facts and reasoning are sound.” As an imitator you will rise and fall with the rest, being at the mercy of the trends that govern their motions, but if you make independent decisions, your success will depend only on whether or not your underlying assumptions are true.

Alice Schroeder, The Snowball