6 Business Lessons from “the Worst Man on Earth Since the Beginning of the Christian Era”

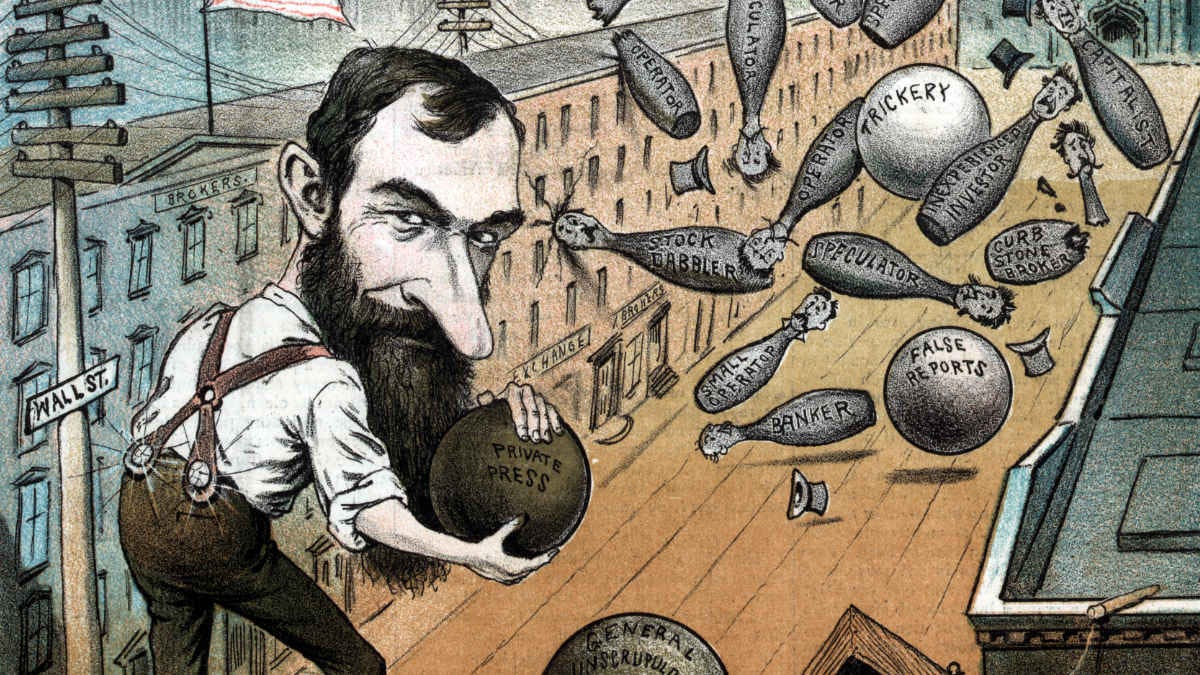

Lessons from Edward J. Renehan Jr.’s biography of Jay Gould—the so-called “Mephistopheles of Wall Street”—one of the wealthiest (and most despised) Americans of all time.

As he was walking down the street carrying his grandfather’s invention inside a beautiful, ornate box, which he was to show to manufacturers attending the World Exhibition in New York, a man ran up to him, snatched the beautiful box out of his hands and sprinted away.

Unshaken, the 17-year-old Jay Gould, together with his cousin Iram, who was accompanying him on this trip, ran after the thief, and, after a short chase, managed to catch and restrain the man. The scuffle attracted attention, and soon a policeman arrived and took the three men to the station.

The thief pretended to be the owner of the box, saying that it was actually Jay and Iram who were trying to rob him. Gould calmly asked the man to say what was inside the box, which, of course, he couldn’t do. Gould then revealed the nature of his grandfather’s invention: a rat trap. As Gould later retold the story, the thief’s face “assumed such an expression of disgust that I could not help laughing at him.” Even the judge couldn’t resist poking fun at the robber, remarking that “the suspect was certainly the largest rat ever caught by a mousetrap.”

This example of unintentional entrapment is a comical foreshadowing of very much intentional traps that Gould would later set up to manipulate and dominate the stock market, which, by the end of his life, would end up making him one of the richest (as well as the most loathed) men in American history (American Heritage ranked him the 9th richest American ever, CNN Money placed him 10th, Bernstein and Swan ranked him 12th1). He became the quintessential “robber baron” of the 19th century, a breed of unscrupulous speculators who made their riches by fully exploiting the unregulated market and the corrupt judicial system of the time.

The story above, as well as those that follow, are taken from Edward J. Renehan Jr.’s excellent biography of Jay Gould, Dark Genius of Wall Street.

1. People will pay for value

Here’s how Gould made his first dollar. When he was still a teenager, he acquired surveying and mapmaking skills with the hope of pursuing a career away from his father’s farm. In March of 1851, a man named Snyder asked Gould if he would assist him in the creation of a map of the Ulster County. Gould took the job, but soon discovered that not only did the man have no money to pay his salary, he had already gone bankrupt several times prior.

Depressed and hungry Gould nevertheless decided to press on. He asked a farmer for some food, explaining that he had no money to pay him, but that he would enter the amount owed into his account book. The farmer agreed. As he was leaving, the farmer asked him whether he could make a noon mark—a type of sundial, such as a vertical line marked on a south-facing wall, which marks midday when the shadow passes it.

Gould did the work and was given a dollar for it, from which he duly subtracted the amount he still owed for the food. As Gould later recalled:

That was the first money I made in business, and it opened up a new field to me, so that I went on from that time and completed the surveys and paid my expenses all that summer by making noon-marks at different places.

People will happily pay for value. Sometimes we grow blind to the opportunities that are open to us because we begin to devalue the skills we’ve already acquired. But what is trivial to us may be difficult or even impossible to others, and as long as the skill has a useful application, however small, so too does it have a market.

Unsurprisingly, Snyder again declared himself bankrupt, but this didn’t deter Gould. He and the other surveyor working on the map decided to finish the project. They acquired the rights for the map as compensation for the salary owed them and brought another person on. Gould, however, still had no money to pay them, so he came up with a clever solution: he reduced his share of the proceeds to 20%, and actually hired himself out to his colleagues for thirty dollars a month plus board. The map was soon finished, and Gould pocketed five hundred dollars as a result.

2. Motion over contemplation

When he was still very young, Gould remarked to his friend, Abel Crosby:

“Crosby, I’m going to be rich. I’ve seen enough to realize what can be accomplished by means of riches, and I tell you I’m going to be rich.” When Crosby asked by what method Gould proposed to achieve this feat, Jay answered, “I have no immediate plan. I only see the goal. Plans must be formed along the way.”

Thinking and planning may be valuable, but, as Netflix co-founder Marc Randolph says: “You’ll learn more in one hour of doing something than in a lifetime of thinking about it.” It is only by taking action that we obtain the information we need to make effective decisions, it is only through motion that we make progress.

While still a teenager, Gould embraced action, using rapid, ruthless motion to his advantage.

When the Shakersville Road Corporation was facing opposition against its building of a stretch of road, Gould provided a solution. He was in a meeting with the company directors, who were discussing the situation with their attorney. As the attorney began to contemplate various strategies for their defense, Gould asked whether or not they could legally begin building the road right away—before the injunction was served. Yes, he was told, they could. Could they protect the workers while the road was being built? Yes, they could.

Wasting no time, before the end of the day Gould hired every laborer he could find, and purchased all the lumber he could buy. He split up the workers into shifts, rotating them so that work could continue non-stop day and night. By the time the opponents got their injunction, the stretch of road they were challenging was already complete.

3. Leverage other people’s money

In 1857, Jay Gould opened a tannery in a 50-50 partnership with Zadock Pratt. Pratt was an old, experienced tanner, who provided the funds for the venture (totaling $120,000 by the end of the partnership), while Gould invested his time and energy into running the operation. The first days of the tannery were fraught with difficulties, but Gould persevered, and the operation soon started to grow at such a rate that it began to produce more pelts than Pratt’s old tannery. A vain man, Pratt was irked at being bested by a junior partner, and their relationship began to deteriorate.

The pelts for the tannery were acquired in a district of New York called “the Swamp,” which, according to Pratt, was “to tanners what Wall Street is to financiers.” Originally, Gould obtained hides for tanning from Corse & Pratt, half of which was owned by Zadock Pratt’s son George. In the spring of 1858, Gould, unsatisfied with his supplier, switched to one of the biggest firms in the Swamp called Charles M. Leupp & Company, from which he obtained better terms. This new relationship turned out to be invaluable.

Here’s what happened. The 1857 Panic caused a collapse in the price of leather, and while Gould’s tannery was working at full capacity, it was making very little profit. Zadock Pratt decided to exploit this temporary downturn by trying to buy out his junior partner at a discount. Pratt told Gould he wanted to terminate the partnership, and this meant either one of two things: he would buy Gould’s share of the business for $10,000, or Gould would have to buy his share for $60,000. Knowing full well that Gould didn’t have the money to buy him out, Pratt likely expected Gould to capitulate and give up his share. On top of this, Pratt gave Gould only ten days to make his decision.

No problem. Gould rushed to his new partners in New York, Charles M. Leupp & Company, and arranged a deal with them to buy out Pratt’s $60,000 share for two-thirds of the company. In this way Gould leveraged other people’s money to both, launch the enterprise and to buy out his partner. As Gould remarked at a later time, after the Black Friday crash (which he himself caused): “a man with $100,000 of money and with credit can transact a business of $20,000,000.” Money isn’t a scarce resource. What’s scarce is judgement and the ability to execute.

4. Don’t worry about looking good

As he began to make his first money on the stock market and rise in status, Gould spent some of his time and energy on cultivating social connections. He went about it in a cold and calculating way, and this transactional approach to socializing irked some of the people he tried to befriend. The following story is an extreme and comical example of Ray Dalio’s principle: “don’t worry about looking good—worry about achieving your goals.”2

The incident happened when he went on a cruise aboard the yacht of the Cruger family along the Hudson river. Not long after he got aboard, Gould began to wonder aloud whether he would have enough time by the end of the trip to make it back in time to catch his train. As the cruise progressed, Gould continued to pester the hosts about ending the boat trip. An irritated Mr. Cruger decided to teach his guest a lesson. He left the centerboard down and ran the yacht aground, minutes before Gould’s train was scheduled to leave. Cruger then taunted Gould by remarking that he would have to swim if he wanted to reach his train on time.

Without missing a beat, Gould undressed in front of the hosts, jumped into the water, and swam down to the shore, using one arm to keep his clothes dry above his head, and rowing with the other. Most people are afraid of embarrassing themselves and will do everything to avoid a scene. Yet it is those who are unafraid to trade a momentary inconvenience for lasting rewards, or to conserve time—the only resource we cannot replenish—who achieve unparalleled success.

5. Find people to compensate your weaknesses

Gould solved the problem of his lack of social graces by teaming up with someone who had them in abundance: James Fisk—a man whose career before Wall Street included door-to-door peddling and a stint at a circus.

Jim was florid and fond of the table, a weakness that was beginning to show in his figure. Gould was abstemious. Jim was loud and self-confident; Gould was silent and seemed diffident. Jim was bold; Gould was cautious. Jim said what he thought; Gould kept his mouth shut. Jim liked to spend his money; Gould kept his. Jim was generous and open-handed; Gould wasn’t. But both men had inexhaustible capacity for work and both were unusually intelligent. They made a formidable combination when they joined forces.

While Gould planned and schemed, Fisk would host meetings with their associates and the press, “supplying ample cigars, liquor, and food.” As one contemporary wrote, Fisk “could manage [the press] better than Gould could. Gould was always intense and therefore serious. His whole mind was centered upon whatever project he happened to have in hand. He was a stronger character than Jim because he was more tenacious; but somehow he didn’t seem to know as much about people.”

Unfortunately for Gould, the histrionic James Fisk met an untimely, dramatic end. Fisk had a lover named Josie Mansfield, who ended up leaving him for Edward Stiles Stokes. On the verge of bankruptcy, Stokes tried to blackmail Fisk using the letters he wrote to Mansfield. Fisk paid up, but Stokes broke his word and attempted to extract more. At this, Fisk sued Stokes for blackmail. On the day a warrant was issued for his arrest, Stokes went to the Grand Central Hotel in Greenwich Village, found Fisk, and shot him twice with his handgun. Fisk died that evening. Although Stokes was convicted of first degree murder, his lawyers’ tenacious efforts reduced the sentence to manslaughter, for which he served just four years in jail.

6. Make the most of a bad reputation

In 1869, Gould began to put in motion his scheme to corner the gold market. The plan involved two parts. The first was to get Ulysses S. Grant, who was the serving president at the time, to reduce the government supply of gold. He did this by exploiting his connections with Abel Corbin, the husband of Grant’s younger sister. The second part was to buy up as much gold as possible from the New York Gold Room.

But Gould overreached himself. His initial efforts did work to inflate the price of gold. However, when Gould learned that Grant was aware of his machinations, he rushed to sell. This triggered a collapse, not just in the price of gold, but in the market as a whole. The event was so significant and had caused so much economic damage that it is remembered the Black Friday of 1869.

While Gould was known as a ruthless speculator, it was Black Friday that caused him to be demonized as “the most cold-blooded corruptionist, spoliator, and financial pirate of his time.” The New York Times called him “the Mephistopheles of Wall Street.” One stockbroker went so far as to call him “the worst man on earth since the beginning of the Christian era.” Gould’s peers, who were all just as happy to exploit and plunder the market, turned against him when his scheme ended up causing them damage.

Although Gould would never recover his reputation, he turned his negative image into an asset:

Gould also used the press to nurture the popular image he’d emerged with after Black Friday: the dark, inscrutable, amoral, and ultimately pitiless master of financial markets. Morosini would recall Gould repeating Machiavelli’s advice from The Prince, that it was better to be feared than to be loved, and explaining that his image as an evil but brilliant wunderkind was his most valuable possession. […] Though the bulk of his contemporaries loathed him, all their eyes were nevertheless upon him. Stocks routinely rose and fell upon whispered news that Jay was long or short in this or that.

Ultimately, Gould was a much more complex character than the demonic caricature painted by his contemporaries. He was a brilliant businessman. He was loyal and helpful to his closest friends and family. He gave freely to charitable causes, doing so anonymously in order to preserve his negative image. And yes, he was also a cunning and unscrupulous speculator, exploiting the corrupt system of his time to his advantage. But in that, he was no worse than his colleagues. His sin was that he did it better than them.

Peter W. Bernstein, Annalyn Swan. All the Money in the World. 2008.

Ray Dalio. Principles. 2017